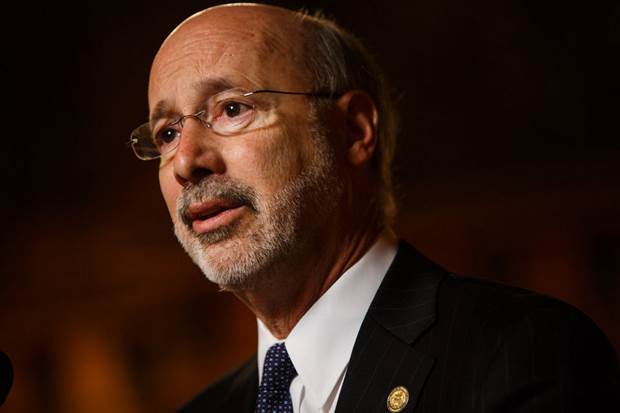

Governor Tom Wolf sits down one on one with PennLive’s Wallace McKelvey

Governor Tom Wolf sits down one on one with PennLive’s Wallace McKelvey March 11, 2015. James Robinson, PennLive.com

James Robinson | jrobinson@pennlive.com

By Marc Levy | The Associated Press The Patriot-News

on March 16, 2015 at 6:39 PM, updated March 16, 2015 at 8:00 PM

HARRISBURG, Pa. (AP) — Gov. Tom Wolf wants to make the state’s first full pension obligation payments in more than a decade and end fast-rising obligation payments for school districts, a top budget official said Monday.

But the Democratic administration’s plan to chip away at roughly $50 billion in debt for the pensions of state and public school employees faces a tough reception in the Republican-controlled Legislature. Top GOP lawmakers have focused instead on cutting future employee pension benefits.

The debt has piled up since 2001 during a period when Pennsylvania became one of the nation’s worst pension-funding delinquents.

Under the plan, Wolf wants to borrow $3 billion by way of a bond issue and persuade Pennsylvania’s two big public employee retirement systems to cut investment management fees by $200 million a year.

“We have tried to put together a comprehensive pension funding plan,” Wolf’s budget secretary, Randy Albright, told the Senate Appropriations Committee.

Under the administration’s plan, the state would make the full required contribution in 2016-2017. That could mean paying more than $2 billion alone to the larger of the two pension systems, the Pennsylvania School Employees’ Retirement System.

Gains from investing the bond proceeds and savings from cutting investment fees would reduce annual payments to PSERS by nearly $1.3 billion for the state and schools districts over five years and $10 billion over 24 years, the administration says. That would ease the steep increases on the current pension obligation payment schedule required by a 2010 law to correct years of underfunding by the state, administration officials say.

Payments would still rise, but at levels possibly below the rate of inflation, Albright said.

Wolf is betting that relaxing some rules around the state-controlled wine and liquor store system will pump up profits by $180 million to pay off the bond. However, the Republican-controlled Legislature must both approve the $3 billion bond issue and any changes to the wine and liquor store system, and neither seems likely.

The House has advanced legislation to effectively privatize the sale of most wine and liquor sales, instead of trying to make the state-controlled system more profitable, as Wolf favors. Meanwhile, Republicans say they worry that borrowing billions to invest for pension contributions is a money-losing maneuver.

Senate Finance Committee Chairman John Eichelberger, R-Blair, said the investment sector does not view it favorably.

“They think the timing isn’t good with the arbitrage situation the way it is,” Eichelberger said.

Republicans in the Legislature have focused on cutting the pension benefits of future employees, although that promises no near-term relief from the rising pension obligation payment schedule for school boards and the state.

Robert Storm

Eastern Region Vice President

www.pscoa.org